House with granny annexe

For multi-generational living, as a place to retire, as an apartment for employees, as accommodation for guests such as relatives and friends or Airbnb visitors. A house with a self-contained apartment has a wide range of uses as well as big financial advantages.

For multi-generational living, as a place to retire, as an apartment for employees, as accommodation for guests such as relatives and friends or Airbnb visitors. A house with a self-contained apartment has a wide range of uses as well as big financial advantages.

What is a self-contained apartment?

A self-contained apartment, also known as an in-law apartment or granny flat, is an additional apartment within a house. The criteria for a self-contained apartment are simple: the apartment generally has to have its own entrance, cooking area and bathroom facilities.

What can a self-contained apartment be used for?

Saying goodbye to the hotel of mum and dad

Are your children already grown up? Is it time for them to fly the nest and stand on their own two feet? Then a self-contained apartment is perfect. Your children will have to start paying a bit of rent but can also start experiencing their first taste of independence.

Additional pension plan or somewhere to retire

By renting out your second residential space, you can earn a nice extra stream income and enjoy a welcome second pension once you retire. Alternatively, you might decide to move into the apartment yourself as you get older.

This used to be common practice on farms: when the time came for the old farmers to retire, they would move into a separate home on the farm. The children inherited the farm and looked after their elderly parents. What may sound a bit old-fashioned actually still happens today. Ageing parents move into a self-contained apartment, while the children move into the main family home above. When building a self-contained apartment, you should ideally consider making it suitable for all generations from the start.

Airbnb and rental

A self-contained apartment can also be a good financial investment. You can significantly reduce the imputed rental value of your home through the additional income from the rented accommodation unit. Not keen on renting out your accommodation long-term so that your own visitors and guests can still come to stay? With Airbnb, you can fill any gaps perfectly and generate additional income at times when your apartment would otherwise be empty.

Why does a self-contained apartment have tax advantages?

Investing in your home

In Switzerland, value-maintaining investments are tax-deductible, while value-enhancing expenses are not. When filing a tax return, you can either claim a flat-rate tax deduction or declare your actual costs.

Immediately after the new building work, it’s probably worth opting for the flat-rate deduction because you’re unlikely to have incurred many maintenance costs. In this case, you can also deduct the operating costs (water, wastewater, electricity and cleaning of shared rooms, etc.). However, if your maintenance costs increase, you should deduct the actual expenses instead of opting for the flat rate.

Building a separate apartment later on

If you’re planning to build a single-family house, it’s definitely worth leaving the option open to add a separate self-contained apartment later and plan for it (water connections and entrances). Then if the time comes when you want to turn the lower floor into a self-contained apartment, some synergies can occur.

You can plan and carry out renovations to the walls or replace the floor of the entire property and deduct the costs for tax purposes. The same also applies to environmental and energy-saving measures, such as installing wall insulation or a sustainable heating system.

Property as an investment

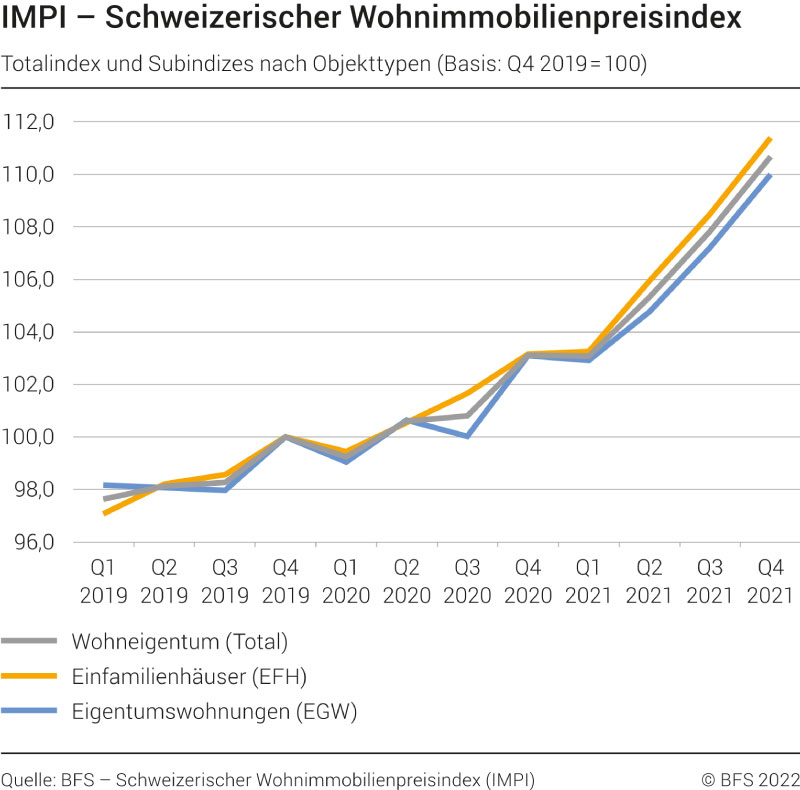

As well as having multiple uses and tax advantages, property is also a very low-risk investment. The residential property price index has been increasing for years and is showing a steep rise (see graph above). In times of negative interest rates and volatile stock markets, acquiring property is a solid investment option.

Advantages

- Flexible and diverse uses

- Additional income

- Property as an investment

- Looked after by your children in your old age

- Tax advantages

Disadvantages

- Limited privacy for the tenant

- Lower rents due to limited privacy for tenant

What does Zebrabox have to do with it?

If you do decide to turn your basement into an additional apartment or even move into an existing self-contained apartment, then you’re bound to notice the reduced storage space available for your things. This is where Zebrabox comes in – thanks to flexible storage solutions in various sizes, you can easily store your infrequently used items in an external storage unit. The storage boxes are always accessible, secure, dry and clean. So why not use a Zebrabox for storage?